At the beginning of last year, I owed more than $20,000 in debt—and I felt like I was slowly suffocating. Most of it was credit card balances spread across multiple accounts, with a car loan adding extra pressure. I wasn’t living lavishly. I wasn’t irresponsible. But I was trapped in the paycheck-to-paycheck cycle, and every month the interest piled higher.

I had tried budgeting apps before. I had read blog posts. I had made half-hearted attempts to “cut back.” But nothing stuck—until I committed to a single goal: I will be debt-free in 12 months. And I did it. What follows is exactly how I paid off $20,000 in one year—and what you can learn from my story to speed up your own debt-free journey.

Contents

- 1 💳 Step 1: Facing the Fear and Getting Honest With the Numbers

- 2 📊 Step 2: Choosing a Payoff Strategy That Fit Me

- 3 💰 Step 3: Building My “Why” and Creating Emotional Fuel

- 4 💸 Step 4: Building a Realistic, Aggressive Budget

- 5 💼 Step 5: Making More Money (Without Losing My Mind)

- 6 🔄 Step 6: Automating What I Could, Manually Tracking What Mattered

- 7 🎯 Step 7: Dealing With Setbacks Without Derailing the Plan

- 8 🧘 What Changed—Beyond the Numbers

- 9 📘 Final Thought: What You Can Learn From My Journey

💳 Step 1: Facing the Fear and Getting Honest With the Numbers

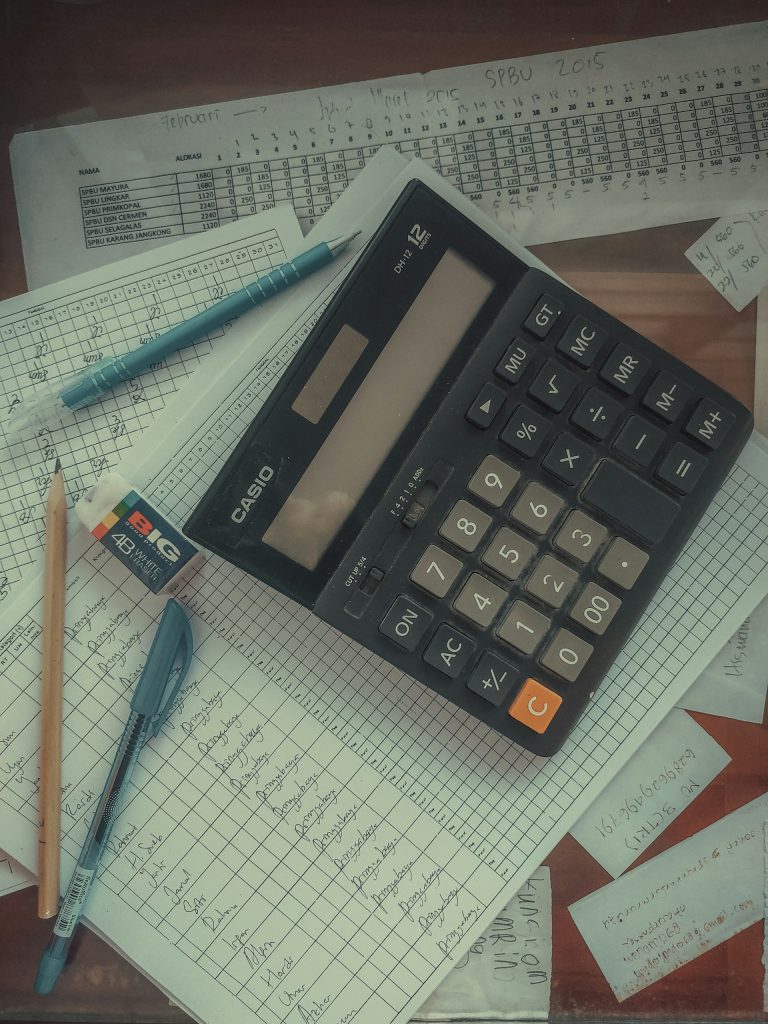

Before anything changed, I had to stop pretending I didn’t know how bad it was. The first day of my journey wasn’t glamorous. I opened every credit card statement, loan account, and bill I had been avoiding.

I created a single spreadsheet and listed:

-

Account names

-

Balances

-

Minimum payments

-

Interest rates

-

Due dates

The total was $20,482 across 5 credit cards and one auto loan. Seeing it all together was brutal—but also motivating. For the first time, I had a target. Not a vague feeling of “too much,” but a real, measurable mountain I could now plan to climb.

📊 Step 2: Choosing a Payoff Strategy That Fit Me

I knew about the snowball and avalanche methods—but which one would I actually stick with?

I chose the snowball method. Why? Because I needed emotional wins. I needed to see a card disappear to believe this was working. I listed my debts smallest to largest and focused every extra penny on the first one, while making minimums on the rest.

When I paid off my first $800 credit card, I nearly cried. Not because of the money—but because I felt capable for the first time.

You might save more with avalanche—but don’t underestimate the power of momentum.

💰 Step 3: Building My “Why” and Creating Emotional Fuel

If you’re going to pay off $20,000 in one year, you’re going to need deep, emotional reasons—not just logic.

Here were mine:

-

I wanted to stop losing sleep over money

-

I wanted to be able to say “yes” to trips and opportunities without guilt

-

I wanted to break the family cycle of always living in debt

-

I wanted to own my paycheck—not owe it to someone else

These reasons became my North Star. I wrote them on sticky notes. I set reminders on my phone. When I was tempted to spend or quit, I went back to my why.

💸 Step 4: Building a Realistic, Aggressive Budget

My old budget was more of a wish list. I needed a real plan—one that worked with how I lived. So I built a zero-based budget using a Google Sheet, assigning every dollar of income to a job.

Here’s what I did:

-

Cut eating out to once a month

-

Cut streaming to one service

-

Switched to grocery store brands

-

Cancelled unnecessary subscriptions

-

Set a weekly cash allowance

I didn’t go full no-spend, but I prioritized everything through the lens of: Will this get me out of debt faster?

Each month, I freed up around $700–$900 for debt payoff. That was my fuel.

💼 Step 5: Making More Money (Without Losing My Mind)

Cutting expenses only got me so far. If I wanted to hit $20K in a year, I had to increase my income.

Here’s what worked:

-

I freelanced 5–10 hours a week in the evenings (writing)

-

I sold old tech, clothes, furniture—everything unused

-

I flipped thrift store items on eBay

-

I used cash-back apps religiously and put that “found” money to debt

Some months I made an extra $600, some $200. But every dollar went to debt—not to reward spending.

This is what made the biggest difference. Increasing income and reducing expenses is what created real acceleration.

🔄 Step 6: Automating What I Could, Manually Tracking What Mattered

To avoid burnout and decision fatigue, I automated minimum payments for all cards and my car loan. But I manually made extra debt payments each week. I wanted to feel the victory. I wanted to be part of the process, not just a passive observer.

Every Sunday night, I reviewed my accounts, updated my tracker, and sent an extra payment—even if it was just $50. This ritual kept me focused. It made debt payoff a lifestyle, not a phase.

🎯 Step 7: Dealing With Setbacks Without Derailing the Plan

Some months were rough. One month my car broke down—$900. Another, I had an unexpected medical bill. But because I had built a $1,000 mini emergency fund first, I didn’t go back into debt. That savings buffer saved my plan more than once.

I also gave myself permission to pause or slow down, but never quit. I always came back to my “why,” refocused, and adjusted the budget as needed.

🧘 What Changed—Beyond the Numbers

By the time I made my final payment, I had repaid:

-

$13,240 in credit card debt

-

$7,242 on my car loan

-

Total: $20,482 in just under 12 months

But the transformation wasn’t just financial. I gained:

-

Confidence I’d never felt before

-

Control over my life and choices

-

Peace of mind at night

-

A budget that worked and a habit system that stuck

I no longer felt ashamed when checking my bank account. I wasn’t ruled by interest payments. I could make future plans—travel, save, invest—without fear.

📘 Final Thought: What You Can Learn From My Journey

You don’t need to earn six figures. You don’t need to be perfect. You need:

-

A clear picture of your debt

-

A plan that fits your mindset

-

A strong emotional “why”

-

A realistic, aggressive budget

-

A way to earn more—even if just temporarily

-

A small emergency fund

-

A way to stay consistent when motivation fades

You can do this. It will take effort. It will take sacrifice. But it’s absolutely possible. The freedom you’ll feel on the other side? It’s worth every hard decision.

Start where you are. Use what you have. Stay in the game. And one year from now, your story might look completely different, too.