So you want to start investing, but the stock market sounds like a foreign language? Don’t worry — you’re not alone.

If you’ve heard people talk about “ETFs” and wondered what that even means, or if you’ve been sitting on the sidelines because you’re afraid to lose money or make the wrong move — this guide is for you.

The good news? ETFs are one of the easiest, safest, and most beginner-friendly ways to get started in investing. And once you understand the basics, you can open an account and invest your first dollar in less than 30 minutes.

Let’s break it all down — no jargon, no fluff.

Contents

- 1 🧠 What is an ETF?

- 2 💡 What Makes an ETF Good?

- 3 📦 Types of ETFs for Beginners

- 4 🏦 How to Buy Your First ETF (Step-by-Step)

- 5 📊 Real Example: Starting With $100

- 6 💥 Common Mistakes to Avoid

- 7 🧾 Beginner ETF Portfolio Example

- 8 💡 Tips for Staying Consistent

- 9 📎 Download: ETF Investment Starter Guide & Planner (PDF)

🧠 What is an ETF?

ETF stands for Exchange-Traded Fund.

Imagine it like a basket of investments — it holds many individual stocks or bonds inside one package. When you buy an ETF, you’re buying a tiny slice of all the companies or assets inside that basket.

For example:

-

An S&P 500 ETF gives you exposure to 500 of the biggest U.S. companies like Apple, Google, and Amazon — all at once.

-

A Dividend ETF holds companies that pay regular income.

-

A Tech ETF might include just tech stocks like Microsoft, Nvidia, and Meta.

ETFs are traded on stock exchanges just like individual stocks, but they’re more diversified and usually lower risk.

Why ETFs Are Perfect for Beginners

-

✅ Low risk (thanks to built-in diversification)

-

✅ Low cost (most have very low fees)

-

✅ Hands-off (you don’t need to pick individual stocks)

-

✅ Easy to buy (available on most investing apps)

ETFs are like the slow cooker of investing: you set it, forget it, and let it work in the background.

💡 What Makes an ETF Good?

When evaluating ETFs, here are a few simple things to look for:

1. Expense Ratio

This is the fee you pay annually for holding the ETF. Lower is better.

👉 Look for expense ratios under 0.10% for core ETFs.

2. Performance & History

Check the past 5–10 years. While past performance doesn’t guarantee future results, it gives you a sense of stability.

3. Diversification

The more companies or sectors the ETF covers, the more protected you are from a single company crashing.

4. Liquidity & Volume

Stick to ETFs with high trading volume — they’re easier to buy/sell and have lower spreads.

5. Reputation of Provider

Well-known issuers like Vanguard, BlackRock (iShares), and Schwab are reliable and well-managed.

📦 Types of ETFs for Beginners

Let’s explore the most popular and beginner-friendly ETFs:

🏛️ Total Market ETFs

These cover the entire stock market, not just the top 500 companies.

-

VTI (Vanguard Total Stock Market ETF)

-

ITOT (iShares Core S&P Total U.S. Stock Market)

✔️ Best for: Broad exposure with a single fund

📈 S&P 500 ETFs

These mirror the S&P 500 index — the 500 largest U.S. companies.

-

VOO (Vanguard S&P 500)

-

SPY (SPDR S&P 500)

-

IVV (iShares Core S&P 500)

✔️ Best for: Long-term growth with minimal risk

💰 Dividend ETFs

These ETFs hold companies that pay out dividends — regular income.

-

SCHD (Schwab U.S. Dividend Equity)

-

VIG (Vanguard Dividend Appreciation)

✔️ Best for: Passive income + growth

🌍 International ETFs

Gives exposure to markets outside the U.S.

-

VXUS (Vanguard Total International Stock ETF)

-

IXUS (iShares Core MSCI Total International)

✔️ Best for: Global diversification

🔍 Sector ETFs

These target specific industries like tech, healthcare, or energy.

-

XLK (Tech)

-

XLF (Finance)

-

XLE (Energy)

✔️ Best for: Advanced investors looking to specialize

🏦 How to Buy Your First ETF (Step-by-Step)

✅ Step 1: Choose a Brokerage Platform

Some great beginner-friendly options include:

| Broker | Fractional Shares | Fees | User-Friendly |

|---|---|---|---|

| Fidelity | ✅ Yes | $0 | ⭐⭐⭐⭐⭐ |

| Charles Schwab | ✅ Yes | $0 | ⭐⭐⭐⭐ |

| SoFi Invest | ✅ Yes | $0 | ⭐⭐⭐⭐ |

| Robinhood | ✅ Yes | $0 | ⭐⭐⭐⭐ |

| Vanguard | ❌ No (currently) | $0 | ⭐⭐⭐ |

Open an account — it takes 5–10 minutes.

✅ Step 2: Deposit Money

Start with what you can. Even $10–$100 is enough to buy fractional shares.

Link your bank account and transfer funds into your investment account.

✅ Step 3: Search and Select Your ETF

Use the ticker symbol (e.g., VOO or VTI) to find your ETF.

Click “Buy,” enter the amount, and confirm. Done!

✅ Step 4: Automate If Possible

Most apps let you set up recurring investments. Even $25/month builds wealth over time.

📊 Real Example: Starting With $100

Let’s say you have $100 and you’re using Fidelity.

You invest:

-

$60 in VTI (total market exposure)

-

$30 in SCHD (dividends for passive income)

-

$10 in VXUS (international exposure)

You now own hundreds of companies worldwide — with just one move.

Check in monthly, and add $25–50 whenever you can.

💥 Common Mistakes to Avoid

-

Trying to day trade ETFs — they’re meant for long-term holding

-

Ignoring fees — check expense ratios carefully

-

Over-diversifying with too many ETFs — 2–3 core funds are plenty

-

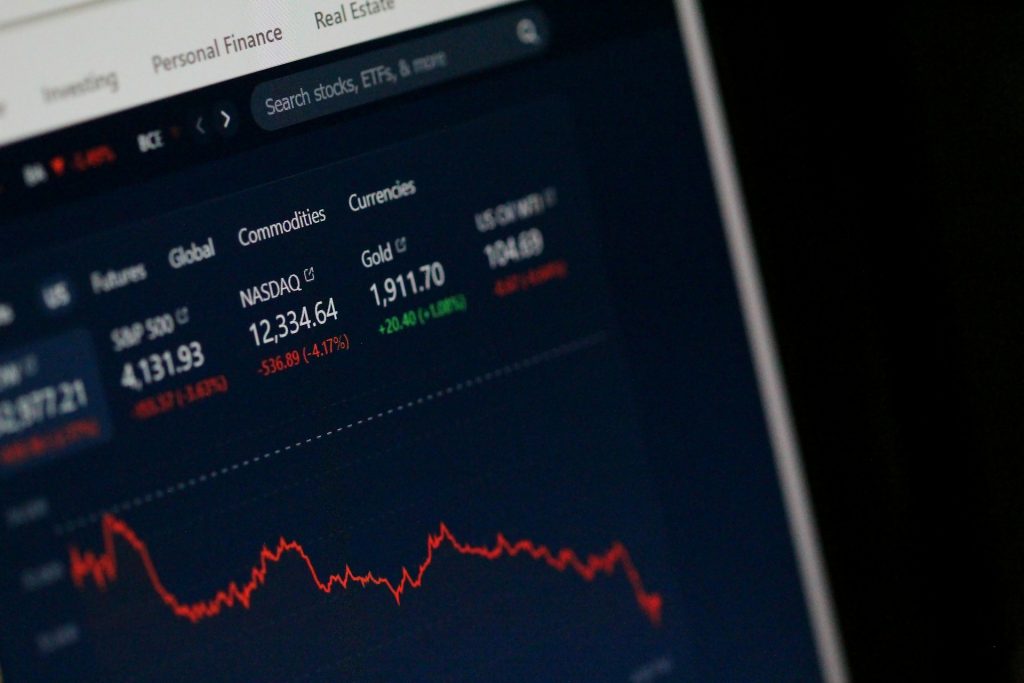

Panicking during a dip — markets go up and down, stay calm

-

Waiting too long to start — the best time was yesterday, the second best is now

🧾 Beginner ETF Portfolio Example

| ETF | Allocation | Type |

|---|---|---|

| VTI | 60% | Total U.S. Market |

| SCHD | 25% | Dividend Income |

| VXUS | 15% | International |

This gives you broad exposure, income potential, and global diversity — a perfect beginner foundation.

💡 Tips for Staying Consistent

-

Use the printable at the end to track your ETFs

-

Set calendar reminders to check once a month

-

Subscribe to ETF newsletters or watch YouTube recaps

-

Reinvest dividends when possible

-

Don’t try to “time” the market — just keep buying

📎 Download: ETF Investment Starter Guide & Planner (PDF)

This printable helps you:

-

Compare ETF options

-

Write down your investing goals

-

Track your monthly investments

-

Stay consistent with your contributions