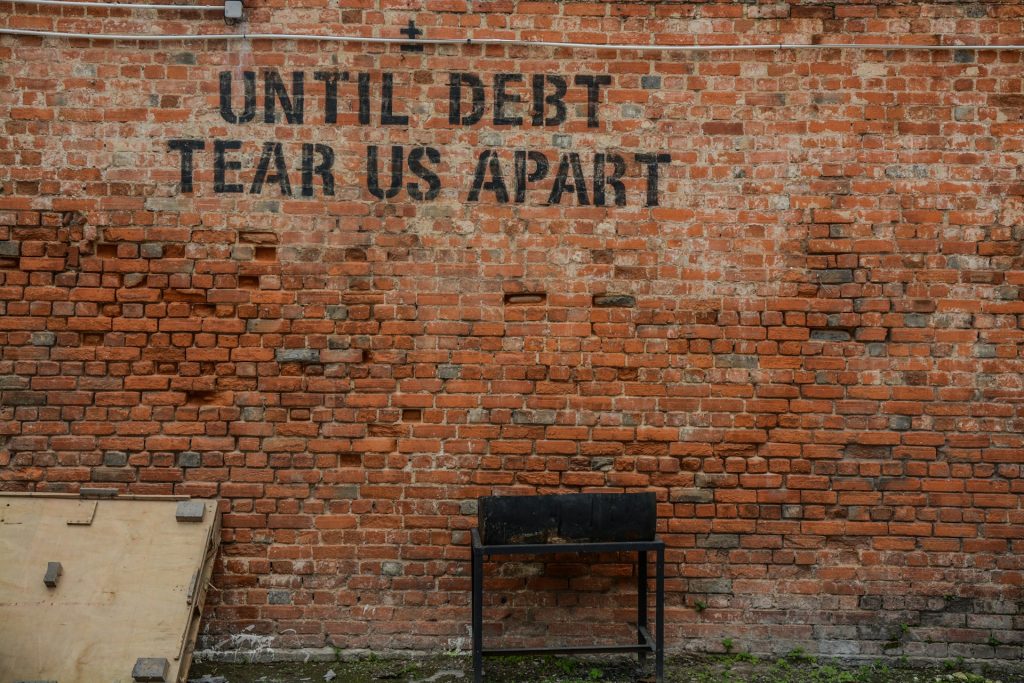

Talking about money with your partner can be uncomfortable. Talking about debt? That can feel downright terrifying.

Whether you’re hiding a credit card balance, dealing with student loans, or navigating shared financial burdens, bringing up debt in a relationship triggers all kinds of emotional landmines—shame, guilt, fear, defensiveness, and even betrayal. But if you’re building a life together, avoiding the topic does more damage than facing it.

Money is the number one cause of arguments and divorces—not because of the debt itself, but because of how we communicate about it (or don’t). This guide will show you how to have constructive, respectful, and emotionally safe conversations about debt with your partner—without blame, drama, or power struggles.

Because building trust around money builds trust everywhere else too.

Contents

- 1 🧩 Why Debt Conversations Are So Difficult

- 2 💬 The Right Time and Place to Talk About Debt

- 3 🧠 Prepare Yourself Emotionally First

- 4 💑 How to Start the Debt Conversation Without a Fight

- 5 🧮 What to Cover in the Debt Talk

- 6 💡 How to Stay Calm During the Conversation

- 7 🛠️ What to Do After the Talk

- 8 📘 Final Thought: Honesty Builds Intimacy

🧩 Why Debt Conversations Are So Difficult

Debt Is Emotional

Debt isn’t just a number on a statement. It can represent:

-

Shame (“I should know better”)

-

Fear (“What if they leave me over this?”)

-

Guilt (“I’ve been lying about this”)

-

Anger (“I’m stuck with their financial mistakes”)

These emotions are raw—and often unspoken. That’s why couples either avoid the topic or fight about it.

Everyone Has a Money Story

We all inherit beliefs about money based on:

-

How we were raised

-

Cultural or religious values

-

Personal experiences (job loss, poverty, wealth, trauma)

-

Media messaging

If your partner avoids debt while you normalize it, or if they hoard savings while you believe in enjoying life now—you’re clashing on values, not just numbers.

Power Dynamics Come Into Play

Money can impact:

-

Who feels in control

-

Who makes decisions

-

Who earns more (and what that “means”)

-

Who takes responsibility—or blame

These dynamics can make even innocent questions feel like accusations, especially if one person has more debt or makes less money.

💬 The Right Time and Place to Talk About Debt

Don’t Drop It in the Middle of a Fight

Never bring up debt when you’re already arguing about something else. This conversation deserves a calm, emotionally neutral space.

Choose a Neutral, Comfortable Setting

Try talking:

-

During a relaxed weekend afternoon

-

On a walk (movement reduces tension)

-

At home when both of you feel safe and unrushed

Avoid discussing debt right before bed, during stressful events, or over text. Tone and context matter.

Set the Intention First

Start with something like:

“I’d really love for us to be on the same page about money. Can we plan a time to talk through our finances—including any debt—so we can make decisions together?”

This invites partnership, not blame.

🧠 Prepare Yourself Emotionally First

Know Your Own Numbers

Before initiating the talk:

-

List all debts

-

Know interest rates, minimums, and balances

-

Reflect on what led to the debt (honestly, without self-shaming)

Being clear helps you stay confident—and factual—during the conversation.

Identify Your Emotional Triggers

Ask yourself:

-

What am I afraid they’ll say or think?

-

What past money experiences am I carrying into this?

-

How do I want to feel after this conversation?

Awareness reduces reactivity. This is especially helpful if money conversations made you feel judged, ignored, or unsafe in the past.

💑 How to Start the Debt Conversation Without a Fight

Use “I” Statements

Lead with your experience—not blame. For example:

-

“I’ve been feeling anxious about our finances and want us to have a clearer picture together.”

-

“I’ve realized I haven’t been fully transparent about my debt, and I want to change that.”

This reduces defensiveness and shows vulnerability.

Reaffirm your partnership:

-

“I want us to be able to make choices together.”

-

“I care about our future and want to build it with you.”

-

“You’re not alone in this—we’re a team.”

This creates emotional safety and shows that this isn’t about blame—it’s about unity.

Normalize Financial Imperfection

You can say:

-

“A lot of people have debt. What matters is how we handle it moving forward.”

-

“I’m learning, and I want to grow in this area—with you.”

Shame thrives in silence. Openness dissolves its power.

🧮 What to Cover in the Debt Talk

1. Total Debt Balances

Each partner should share:

-

Credit cards

-

Student loans

-

Medical or personal loans

-

Buy Now, Pay Later accounts

-

Any other outstanding balances

Transparency is key. Don’t inflate, deflate, or hide balances.

2. Monthly Obligations

Discuss:

-

Minimum payments

-

Interest rates

-

Auto-pay setups (or missed payments)

-

Which debts are high priority

This helps with practical planning.

3. Emotional Associations

Each of you should share:

-

What stresses you about money

-

How debt makes you feel

-

What financial security looks like to you

This deepens understanding and reduces judgment.

4. Responsibilities and Next Steps

Plan:

-

Who pays what

-

Whether you’ll combine finances or keep separate accounts

-

How you’ll make joint decisions moving forward

-

A timeline for paying down high-interest debt

Collaboration builds trust. Clear plans reduce resentment.

💡 How to Stay Calm During the Conversation

Take Breaks if Needed

If things get tense, hit pause:

“Let’s take a 10-minute break to breathe and come back to this with fresh minds.”

Acknowledge Emotions, Not Just Numbers

Say:

“I’m noticing I’m feeling defensive—let me step back for a second.”

or

“It sounds like that really upset you. I appreciate your honesty.”

This models emotional intelligence and invites mutual respect.

Avoid Absolutes and Accusations

No “you always” or “you never.”

No “this is your fault.”

No sarcasm or bringing up past unrelated issues.

Stay present. Stay constructive.

🛠️ What to Do After the Talk

1. Create a Financial Dashboard Together

Use a shared spreadsheet or app to track:

-

Debts

-

Due dates

-

Joint goals

-

Progress

This keeps everything transparent and reduces mental load.

2. Plan Regular Money Check-Ins

Set a “money date” once a month to:

-

Review progress

-

Talk about upcoming expenses

-

Adjust your strategy

-

Celebrate wins

Consistency reduces tension and builds confidence.

3. Consider Financial Counseling (If Needed)

If conversations keep turning into arguments, or if you can’t agree on a plan, bring in a third party:

-

A financial coach

-

A couples therapist specializing in money

-

A nonprofit credit counselor

Outside support can help bridge communication gaps.

📘 Final Thought: Honesty Builds Intimacy

Debt can feel like a dirty secret. But it doesn’t have to be.

Talking about it openly—with compassion, humility, and a shared sense of purpose—can actually bring you closer. It shows maturity, respect, and a willingness to build trust in even the most vulnerable areas.

So take a deep breath. Open the door. You don’t have to be perfect. You just have to be honest—and willing.

Because love that can’t survive a debt conversation isn’t the kind of love that can build a life.